Previous Post

Types of Small Business Insurance

Next Post

Five Marketing Trends for 2022

May 16, 2022

Why Does Your Small Business Need Financial Projections?

Financial projections are a challenging task for start-ups and existing businesses looking to evaluate historical and future financial performance. Financial projections help entrepreneurs plan, forecast, evaluate, and refine their financial strategies to better manage their business. Financial projections help determine what’s on the horizon for the business, will new employees need to be hired, will owners need to invest in capital expenditures, or consider opening additional locations.

While financial projections might seem daunting, they provide insight for small businesses to plan for the future as well as data and information that potential lenders need to understand a business.

The Duquesne University Small Business Development Center has the tools, resources, and expertise to simplify the process of creating and refining accurate financial projections.

Do You Have a Viable Business Idea?

Before getting started with financial projections, entrepreneurs should first determine that they have a viable business idea.

This can be completed using one of three methods:

- A lean business plan

- A business pitch

- A full business plan

A lean business plan is a bare-bones description of strategy, tactics, schedules, and financials, intended for management use. A lean plan is often a collection of bullet points. A business pitch is a one-page document or short presentation that serves as a roadmap of a business and summarizes the opportunity, desired funding, sales and marketing, financial projections, and team. A full business plan provides greater detail around the elements covered in a business pitch.

Think of a forecast as taking the things already known about a business and projecting them forward in an ordered way. To begin, go back to the plan and review what is sold, who it is sold to, how it is sold, and who and what is relied on to get that done. Use industry benchmarks and the business’s financial history to inform estimates for major expenses such as rent, marketing, and payroll. It’s important to remember that these initial numbers are just estimates. They don’t need to be perfect and will likely change over time.

Financial Assumptions

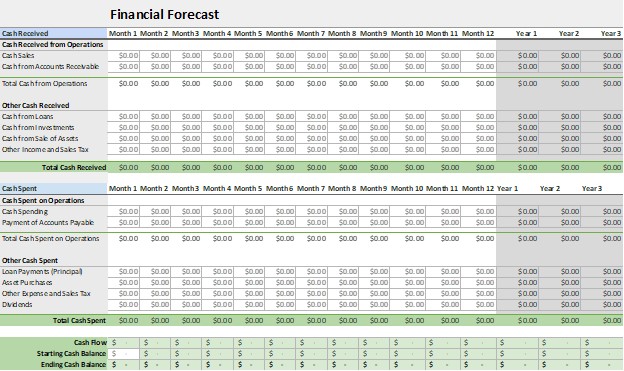

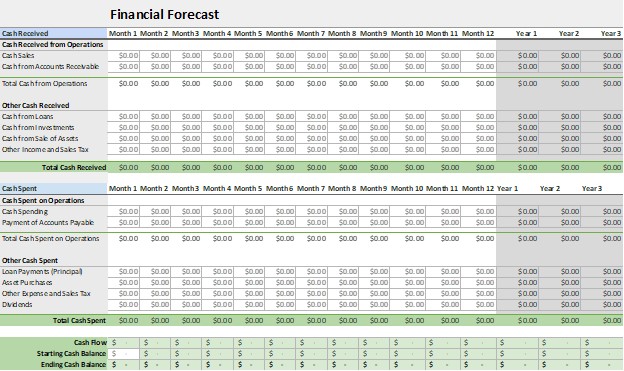

Next, make a list of key assumptions. Think of things like what kind of growth is assumed, what are the unit costs, what is the production capacity and how can that change, what are the key hires and notable expenses, is there seasonality, and what level of profit is expected to be generated. Starting with revenue, set up categories covering the types of sales and their associated expenses. A good starting point is 3-10 sales (revenue) categories, and whatever expense categories come to mind (the fewer the better). Using what is known, plugin revenue and expense values monthly for the first year, followed by annual values for years 2 and 3. Below is an example of a financial forecast layout in its most basic form. Categorized line items should be added for cash received and cash spent.

Direct Costs

Using the same approach as revenue, estimate direct costs (also known as costs of goods sold – COGS), which are costs that are attributed to the production of a specific product or service. These include direct expenses for materials used to create the product and labor costs that are exclusively used to create the product. These do not include items such as marketing, rent, and insurance. Now project payroll expenses in terms of staffing. When projecting personnel costs, a common approach is to add between 12 and 40 percent to account for payroll taxes and benefits.

Operational Expenses

Move on to enter estimates of operational expenses. These are general expenses incurred every month and are both fixed and variable. Items like rent and insurance are fixed, while items such as advertising and utilities are variable. Now consider what level of financing is needed, as well as the terms and monthly payments associated with this. Include the monthly payment as an operational expense. Other things that might be considered in a forecast include assets, dividends, taxes, collections, and payment schedules.

How to Review Your Projections?

With estimates in place, review the projected profit to look for any discrepancies or missing information. Pay attention to anything that looks abnormal, out of place, or not in line with what is known about the business. Check the forecast against industry benchmarks to ensure that major categories and overall profitability agree with industry standards. Continue to learn, ask questions, and refine your financial projection as needed.

The Duquesne University Small Business Development Center (SBDC) offers no-cost, confidential consulting services and educational programs in Southwestern Pennsylvania to empower entrepreneurs and small business owners with the knowledge they need to start, grow, and prosper.

Next Steps

Our consultants here at the SBDC are ready to help you whether you are looking to start an LLC or a sole proprietorship. You can request no-cost consulting by completing this form.The Duquesne University Small Business Development Center (SBDC) offers no-cost, confidential consulting services and educational programs in Southwestern Pennsylvania to empower entrepreneurs and small business owners with the knowledge they need to start, grow, and prosper.

Comments (0)