February 11, 2021

Over the years, the Duquesne University Small Business Development Center has helped more than 900 clients to start small businesses. In 2021, 39 pre-venture clients of the SBDC registered their businesses in the Pittsburgh region. Our consultants have helped them to secure a total funding amount of $9.3 million.

Most small business owners would tell you one of the most difficult stages of managing a business is starting whether you are starting an LLC, a sole proprietorship, or a corporation. Generally speaking, entrepreneurs are experts at what they do but, they get confused about registering a business, deciding on the business structure, and the tax implications.

I know you wish you could skip these and open your doors as soon as possible, but even reading this guide is a big step towards opening your doors!

The steps of starting a small business are pretty much the same whether you are starting a consulting business, a cleaning business, or a photography business. Let us get started!

How to Start a Small Business in Pennsylvania: The Ultimate Guide 2022

- Business Structure - LLC vs Sole Proprietorship

- Getting a Federal Employer Identification Number (FEIN or EIN)

- Registering with the Pennsylvania Department of State

- Opening a Business Bank Account

- Buying Business Insurance

- Creating a Business Plan

- Projecting Your Revenue and Expenses

1. Business Structure - Sole Proprietorship vs. LLC

The first thing you need to decide is your business structure. 72% of all businesses in the U.S. are sole proprietorships. It is simple to form a sole proprietorship. You do not need to register, and it is easier to manage and file taxes. However, your personal assets are not protected from business liability. To learn more about starting a sole proprietorship in Pennsylvania, check out our complete guide.A second common type of business is a Limited Liability Company (LLC). Although single-member LLCs are considered sole proprietorships for tax purposes, LLC is a separate entity. In other words, your assets are protected under an LLC.

How to Decide?

We advise our clients to start a sole proprietorship if they are testing the waters and not sure about the future of their business or keeping their day jobs and looking to make some extra money. However, if you want to protect your personal assets from business liability, and want to grow your company in the long term then you should opt for an LLC.What are the other options?

You can also start an S or C corp. However, these corporations are a little more difficult to manage and complicated in terms of taxes. If you want to learn more about business structures, head to our guide.2. Apply for a Federal Employer Identification Number (FEIN or EIN)

The next step for your small business is to apply for an Employer Identification Number (EIN). Go to IRS.gov and apply for an EIN. If you are starting a sole proprietorship, you do not need to apply for an EIN. You can use your SSN instead.3. PA Business License – Business Name Registration

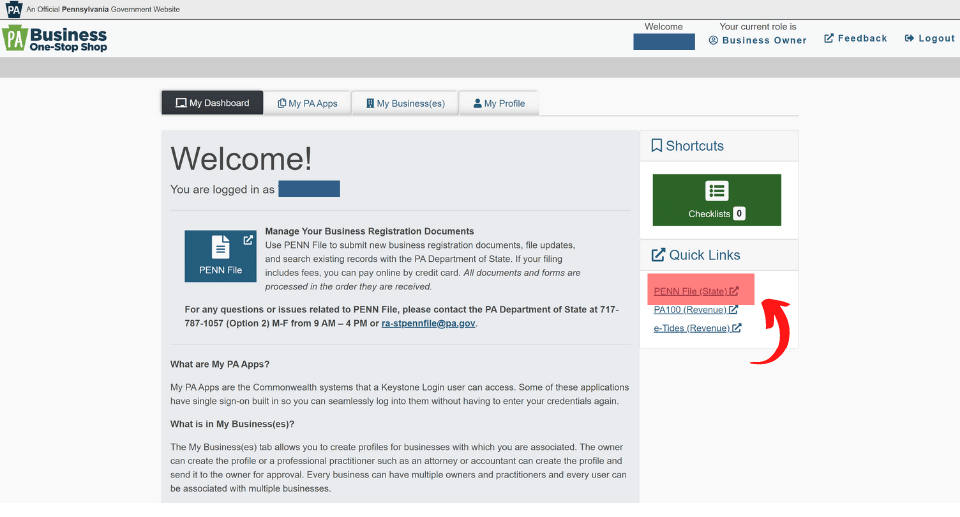

After you decide your business structure and apply for an EIN, head to Pennsylvania Business One-Stop-Shop to get a business license and officially become a small business owner. First, create an account with PA One-Stop-Shop and go to the PENN file (see below). If you are considering starting a sole proprietorship, you can skip this step as you do not need to register your small business.

Business Name Lookup

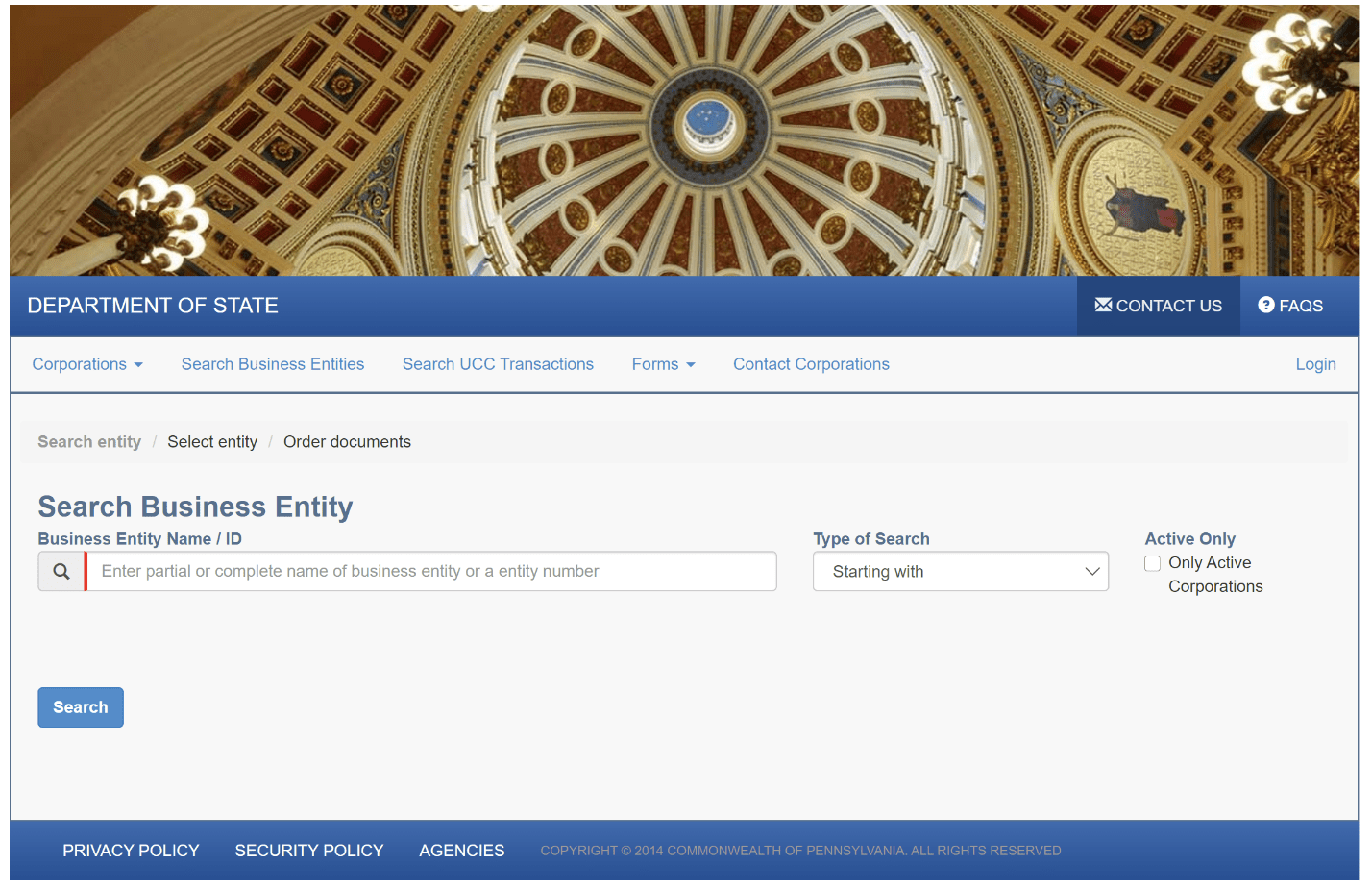

If you want to make sure your business name is available, you can use the PENN File Business Entity Search feature. You can look up your business name and see if it is taken by someone else.

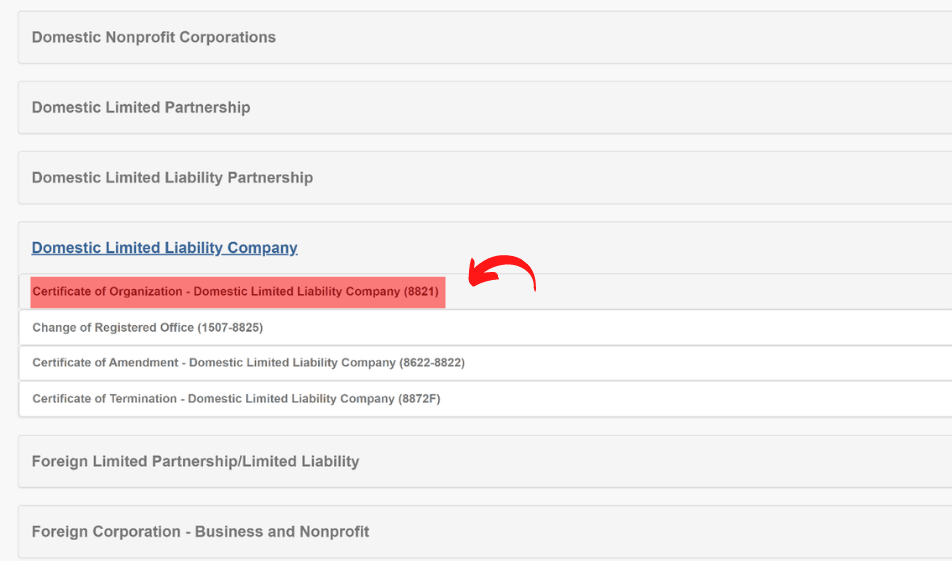

Articles of Incorporation

After you make sure your business name is available, you can start filing your application.

How much does a business license cost?

Registering an LLC (filing Articles of Incorporation) with the Pennsylvania Department of State is $125. If you are filing your application yourself, this should be the only fee that you pay. However, if you use third-party websites or consultants, you will end up paying more. Just a reminder that Duquesne University SBDC consultants can help you register your business at no cost (except for a fee of $125 mentioned above).4. Opening a Business Bank Account

After you open your doors, if you do not want IRS to be your first customer, keep your personal and business financials separate!Whether you are a sole proprietor or an LLC, we highly suggest opening a new business account for your small business. This will help you to better track your business income and expenses, and it will also keep things simple when filing taxes. Typically, you need a state-issued ID, EIN, or Social Security Number and your Articles of Organization (if you are an LLC).

5. Bookkeeping

Bookkeeping is recording and organizing your business transactions. You can use a simple spreadsheet or software to track and record your transactions. If you are dealing with different accounts, we highly suggest using QuickBooks (Online Version). QuickBooks is the most widely used small business accounting software.But before setting up your business accounts, become familiar with the basic types of accounts: assets, liabilities, revenue, expenses, and equity.

If you want to learn more about business accounts and financial statements, you may want to check out our calendar and sign up for our First Step Business Essentials or Understanding Financial Statements programs.

6. Insurance

There are a couple of different types of business insurance for small businesses, such as general liability insurance, workers’ compensation insurance, professional liability insurance, and data breach insurance. If you want to learn more about each of these types of insurance, you can check out our insurance guide.It depends on your industry whether you need all these insurances. That said Workers’ compensation insurance is mandatory for all employers with one or more employees (regardless of employment status and the number of hours worked) according to the Pennsylvania Department of Labor and Industry. In addition to workers’ compensation, we highly suggest purchasing general liability insurance (business liability insurance). This can protect you from a variety of claims including bodily injury, property damage, personal injury, and others that can arise from your business operations.

7. Business Plan

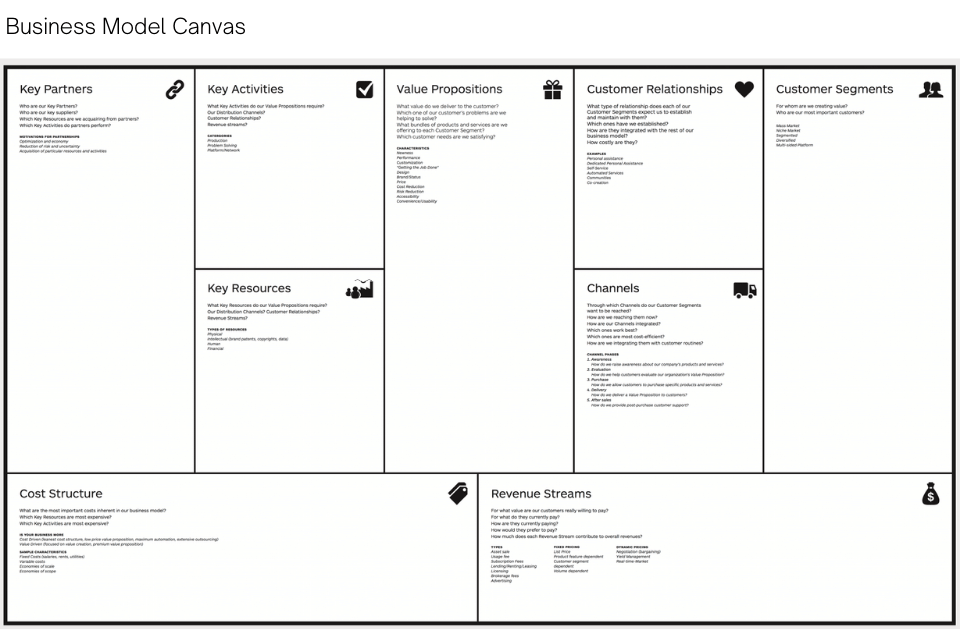

This is something that you should not procrastinate on! Whether you seek funding or not, a business plan is something that will guide you along the way and keep you focused.A business plan is a must-have document for new businesses. It tells how you will make money, what are your first, second, and third-year goals are, what your marketing plan is, and more. So, a business plan is the backbone of your business. Our business plan guide is a great resource if you need an example of an outline.

It’s always a good idea to start with a business model canvas before writing your business plan. It’s a one-page document that shows your key business activities.

8. Financial Projections

From our experience, I could easily tell the financial projections part is by far the most intimidating step for entrepreneurs, which should not be!The key here is to start with your assumptions. So, think about how many products you will sell in the first months. What is your rationale? How much growth are you anticipating each month? Again, what is your rationale? Will you add new products? What are your expenses? Will you pay rent? Will you hire employees?

If you start with these simple questions, all you need to do is put these numbers into a spreadsheet. Here is a cheat sheet on how to prepare financial projections.

I hope after reading this guide, you feel more confident about starting a business. Starting a business is a big step, but it’s a process, and you should take one step at a time. Also, support from your family, friends, other small business owners, and mentors will help you to get there.

We’re Here to Help!

Duquesne University SBDC is funded by the SBA and offers no-cost, confidential consulting services in southwestern Pennsylvania to help entrepreneurs and small businesses to start and grow. If you want to start working with our business consultants, feel free to request a free consulting session.

Comments (0)